Cheque Printing Software: A Smarter, Safer Way to Manage Business Payments

Introduction

Even in a digital-first world, cheques remain a trusted and widely used payment method across many industries. From payroll and vendor payments to refunds and official disbursements, cheques continue to play a critical role in business finance. However, manual cheque writing is slow, error-prone, and increasingly risky. This is where cheque printing software becomes essential.

Modern cheque printing software transforms a traditionally manual process into a secure, automated, and professional system. It helps organizations reduce errors, save time, improve compliance, and maintain financial control. This article explains what cheque printing software is, how it works, its benefits, key features, and how businesses use it in real-world scenarios.

What Is Cheque Printing Software?

Cheque printing software is a specialized application that allows businesses to design, print, and manage cheques directly from their accounting or financial systems. Instead of handwriting cheques or relying on pre-printed formats, users can generate cheques dynamically using blank or standard cheque paper.

The software pulls payment data such as payee name, amount, date, and bank details from accounting records and prints them in the correct format, aligned with banking standards. Most solutions also include security features, audit trails, and integration with accounting software.

In simple terms, it replaces manual cheque preparation with an accurate, controlled, and auditable process.

Why Businesses Still Use Cheques

Despite the growth of online payments, cheques remain relevant for several reasons:

Many vendors and institutions still require cheque payments.

Cheques provide a clear paper trail for audits and compliance.

They are commonly used for payroll, tax payments, and government transactions.

Some regions have limited access to digital banking infrastructure.

According to global payment studies, cheques still account for a notable percentage of B2B payments, particularly in developing and regulated markets. As long as cheques exist, the need for efficient cheque management remains.

Key Benefits of Cheque Printing Software

Improved Accuracy and Error Reduction

Manual cheque writing often leads to spelling mistakes, incorrect amounts, or misaligned printing. Cheque printing software eliminates these risks by automating data entry and formatting. Once the data is verified in the system, the cheque prints correctly every time.

This is especially valuable for payroll and high-volume payments, where even a single error can cause delays and disputes.

Time and Cost Savings

Printing cheques manually consumes staff time and requires pre-printed cheque stock. Cheque printing software allows businesses to:

Print multiple cheques in minutes

Use blank cheque paper instead of expensive pre-printed stock

Reduce reprinting and wastage

Over time, these savings add up, particularly for organizations that issue cheques regularly.

Enhanced Security and Fraud Prevention

Cheque fraud is a real concern. Modern cheque printing software includes multiple layers of protection, such as:

Password-controlled access

User roles and approval workflows

Encrypted data storage

Security fonts and background patterns

These controls reduce the risk of unauthorized cheque issuance and internal fraud.

Professional Appearance and Brand Consistency

Printed cheques look cleaner, clearer, and more professional than handwritten ones. Businesses can include logos, standardized layouts, and consistent formatting, which enhances credibility with vendors, banks, and auditors.

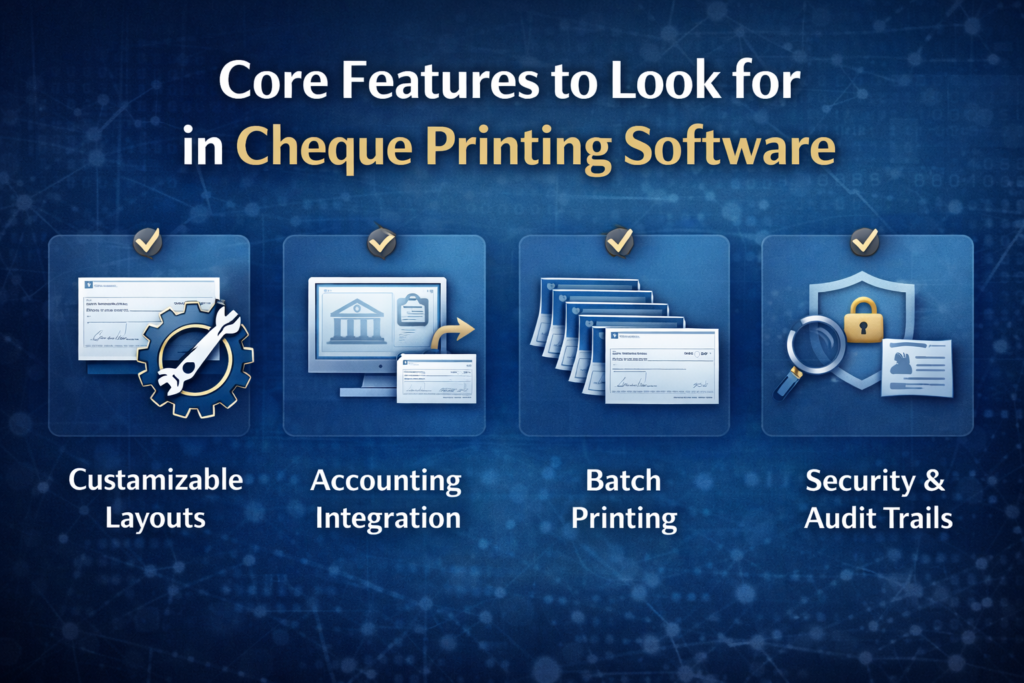

Core Features to Look for in Cheque Printing Software

Not all cheque printing solutions are the same. High-quality software typically includes the following capabilities.

Customizable Cheque Layouts

Different banks and regions follow different cheque formats. Good software allows users to customize layouts to match local banking requirements, including:

Cheque size and alignment

Placement of MICR codes

Payee and amount positioning

This flexibility ensures compatibility across multiple banks.

Accounting Software Integration

The best cheque printing software integrates seamlessly with popular accounting systems. This allows payment data to flow automatically, reducing duplicate data entry and improving accuracy.

For example, a finance officer can approve a payment in the accounting system and print the cheque instantly, without retyping details.

Batch Printing and Scheduling

Businesses that process multiple payments benefit from batch printing. Instead of printing cheques one by one, users can print dozens or hundreds of cheques in a single run, saving significant time.

Audit Trails and Reporting

Strong audit features are essential for compliance. Cheque printing software often records:

Who printed each cheque

When it was printed

Whether it was voided or reissued

These records are invaluable during audits and internal reviews.

Real-Life Business Use Cases

Payroll Processing

Small and medium enterprises often use cheques for payroll, especially for contractual or field staff. Cheque printing software enables payroll teams to generate accurate cheques quickly, ensuring employees are paid on time and reducing payroll disputes.

Vendor and Supplier Payments

Procurement departments use cheque printing software to pay suppliers efficiently. With batch printing and approval workflows, finance teams can process large vendor payments while maintaining control and traceability.

Educational Institutions and Nonprofits

Schools, colleges, and nonprofit organizations frequently rely on cheques for grants, stipends, and reimbursements. Cheque printing software helps these organizations meet compliance requirements and maintain transparent financial records.

Compliance and Regulatory Consideration

Cheque printing software supports compliance with financial regulations by enforcing standardized processes. Many systems allow alignment with internal financial policies, such as dual approvals for high-value cheques.

In regulated sectors, this structured approach reduces the risk of non-compliance and strengthens internal controls. During audits, digital records and logs provide clear evidence of financial discipline.

Choosing the Right Cheque Printing Software

Selecting the right solution depends on business size, transaction volume, and regulatory environment. Consider the following factors:

Ease of use and learning curve

Compatibility with existing accounting systems

Security features and access controls

Local banking format support

Vendor support and software updates

A small business may prioritize simplicity, while a larger organization may focus on scalability and advanced controls.

Implementation Best Practices

To get the most value from cheque printing software, businesses should follow a structured implementation approach.

Start with a pilot phase to test layouts and bank acceptance.

Train staff on correct usage and approval processes.

Define clear roles and permissions to prevent misuse.

Regularly review logs and reports to detect anomalies.

Proper setup ensures smooth adoption and long-term benefits.

The Future of Cheque Printing Software

While digital payments continue to grow, cheque printing software is evolving rather than disappearing. Modern solutions increasingly include hybrid features, such as integration with electronic payment systems and digital approval workflows.

This evolution allows businesses to manage both traditional and modern payment methods within a single financial ecosystem, providing flexibility during the transition to fully digital finance.

Frequently Asked Questions

What is cheque printing software used for?

Cheque printing software is used to create, print, and manage cheques electronically, reducing manual work, errors, and security risks.

Is cheque printing software secure?

Yes. Most modern solutions include access controls, audit trails, and security printing features that significantly reduce fraud and unauthorized use.

Can cheque printing software work with blank cheque paper?

Many solutions support blank cheque printing, allowing businesses to save costs and print cheques on demand.

Do banks accept cheques printed using software?

Yes, as long as the cheque format complies with banking standards and includes required security elements.

Is cheque printing software suitable for small businesses?

Absolutely. Small businesses benefit from faster processing, professional presentation, and reduced administrative effort.

Conclusion and Call to Action

Cheque printing software offers a practical, secure, and efficient solution for businesses that still rely on cheque payments. By automating cheque creation, improving accuracy, and strengthening financial controls, it transforms an outdated process into a modern workflow.

Whether you manage payroll, vendor payments, or institutional finances, adopting the right cheque printing software can save time, reduce risk, and enhance professionalism. Now is the time to move away from manual cheque handling and embrace a smarter approach to financial management.